Simple Ira Limits 2024 Over 55

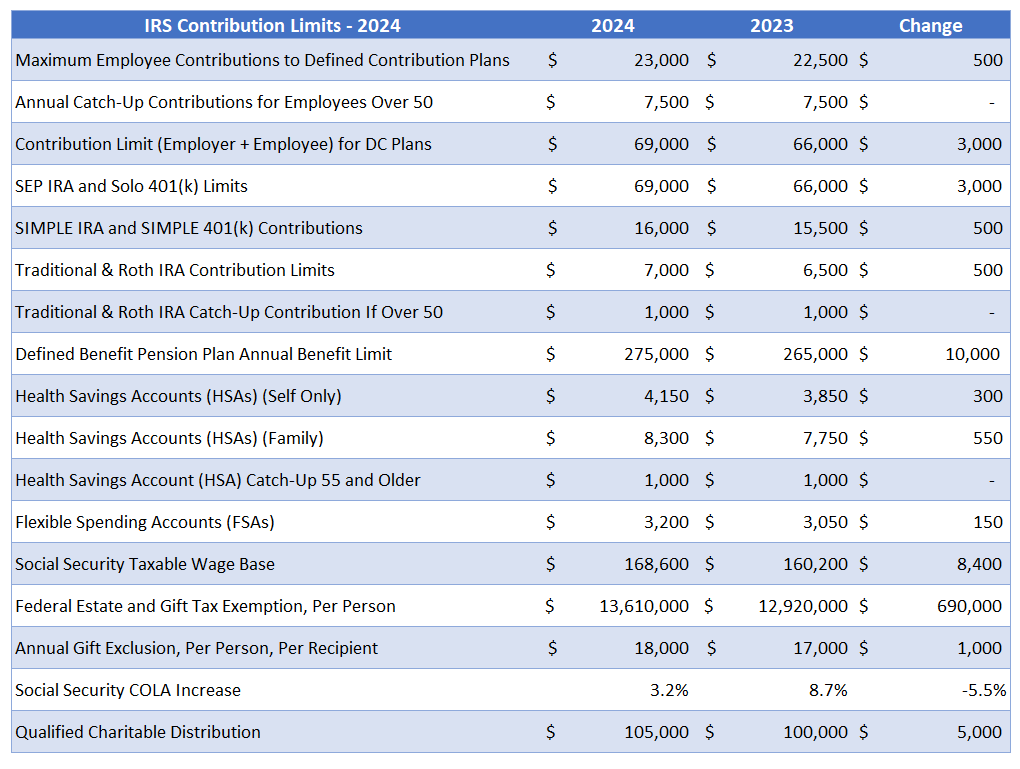

Simple Ira Limits 2024 Over 55. The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023). The 2024 simple ira contribution limit for employees is $16,000.

The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023). Your personal roth ira contribution limit, or eligibility to contribute at.

Simple Ira Limits 2024 Over 55 Images References :

Source: raventamiko.pages.dev

Source: raventamiko.pages.dev

Ira Limits 2024 Catch Up Debi Charleen, Simple ira contribution limits for 2024.

Source: valareewilsa.pages.dev

Source: valareewilsa.pages.dev

Simple Ira Limits 2024 And 2024 Carol Cristen, The simple ira contribution limit for 2024 is $16,000.

Source: laetitiawarlene.pages.dev

Source: laetitiawarlene.pages.dev

Simple Ira Contribution Limit For 2024 Alys Marcellina, This article provides a comprehensive overview of the current limits for individuals and employers.

Source: joyabphaidra.pages.dev

Source: joyabphaidra.pages.dev

Simple Ira Limits 2024 Andi Madlin, What are the contribution limits for a simple ira for sole proprietors?

Source: diannebnorina.pages.dev

Source: diannebnorina.pages.dev

2024 Ira Contribution Limits Chart With Catch Up Arly Marcia, The simple ira contribution limit for 2024 is $16,000.

Source: christabellawkayla.pages.dev

Source: christabellawkayla.pages.dev

Ira Contribution Limits 2024 Over 55 Selma Danyelle, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: nickiydorothee.pages.dev

Source: nickiydorothee.pages.dev

2024 401k Catch Up Contribution Limits 2024 Over 55 Kass Sarene, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: dixybellina.pages.dev

Source: dixybellina.pages.dev

Roth Max Contribution 2024 Over 55 Cally Corette, If you participate in a simple ira plan (often used by small businesses), the contribution limit for 2024 is $16,000, up from $15,500 in 2023.

Source: aletheawdode.pages.dev

Source: aletheawdode.pages.dev

Roth Ira Contribution Limits 2024 Over 50 Years Of Age Edith Heloise, For 2024, a sole proprietor can contribute up to $16,000 in salary reduction contributions, plus an.

Source: aletabannetta.pages.dev

Source: aletabannetta.pages.dev

Simple Ira Employee Contribution Limits 2024 Cary Clarine, Traditional ira and roth ira.

Posted in 2024